Date: 2019-09-12

The first time I ever understood the concept of buying and selling gold was back in my school days when a popular Nepali gold and diamond retail brand, Riddhi Siddhi Jewellers, aired its advertisement on TV. That commercial still plays in the subconscious state of mind as I remember how wittily the commercial was promoting exchange of gold with diamond plus additional money during the days when gold prices were skyrocketing. I will just drop down a link of the commercial so that you can relate.

https://www.youtube.com/watch?v=x3HFMQgOgOs

Few years later, I found out retail gold shops in New Road were forced to shut down their shops because of the low price of gold. The speculation between the rise and fall down of gold prices often interests all of us on daily basis.

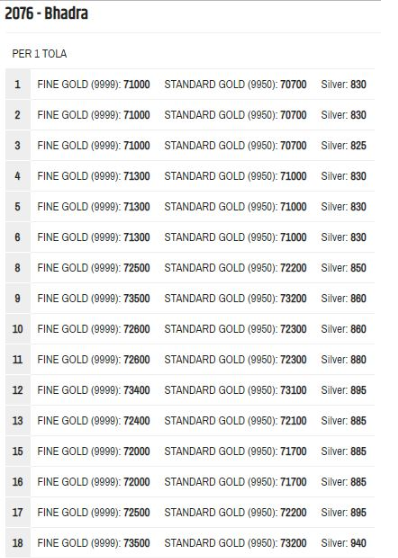

Meanwhile, gold prices have been humming along in the global market, speculations are being made that upcoming years are going to be fruitful for investors in gold rather than investors in equity. The price of fine gold currently stands at Rs 71,700 per tola and that of Tejabi gold stands at Rs 71,400 per tola. The state of gold prices within Bhadra can be inferred from the following table:

Gold, the yellow metal, is often called the safe heaven and the global currency. The price of gold varies on day to day basis. There are several factors that are behind the price of gold. One of these is spot price. In general terms, spot price is the current monetary value paid to buy an asset. In this case, the spot price is the price at which gold can be fetched from the global commodity market. Nepal has no mine that fetches gold so, a lot of factors are involved when the price of gold is determined in Nepalese market. In international market, London Bullion market (a wholesale global market where trading of gold is done) determines the price of gold on daily basis. The London Bullion Market determines the price of per ounce gold. Many central banks make purchases and sales of gold. So, the spot price of the gold and the charge of an importing bank while buying gold make the total monetary value of per ounce of gold in US dollar. Now, this US dollar is further converted into Indian Rupees (INR). Since, Nepal’s currency is pegged with Indian rupees; Nepal has further added cost in the price of gold as the government needs to convert INR to NPR. This is how the price of gold is determined in Nepal.

What is driving the cost of gold to go higher and higher?

We just saw in the earlier paragraphs, in order to simply calculate the price of gold, a lot of factors are involved. Now, in order to drive the price of gold to go up, a number of factors are responsible.

Currently, if we see the international market, a lot of speculations are being made in regards to the upcoming days. There has not been a day in last few months that we have waked up to President Donald Trump’s bombarding tweets regarding trade war with China. One of the major factors that have driven gold prices is the anticipation of trade war between these big giant countries. So, how can a trade war between two countries be responsible for the prices of gold? Going back to history, President Trump has been warning to increase tariffs on imports of goods made in China because Trump believes a tariff will help to increase production in USA. He further believes that this step will bring back all the jobs to USA. President Trump asserts that big companies have moved their manufacturing to China due to its cheap labor force. So, as President Trump administration’s policies are against Chinese economy, China will also use several tactics in order to increase its imports in other oversea countries. As a result, China would choose to devalue its currency against US Dollar. So, what good will a devalued currency do to the economy of China? Basically, a devalued currency means that the currency is cheaper against US Dollar. So, now other oversea countries would prefer to import Chinese goods instead of US goods because the Chinese currency is cheaper. Furthermore, China will also cut its import and rather buy good made within China. Now, amongst all these, there are several investors in equity market, foreign exchange (FOREX) market, commodity market who are unsure about the profit from a specific field. The value of currencies would depend on the policies, talks and agreements between these nations. So, during the times of such uncertainty, investors prefer to invest in gold as it is the safe heaven. As a result, investors worldwide are demanding gold that has pushed up the price of gold.

There is one more reason that has escalated the prices of gold. This specific reason is threatening the whole world as it once did back in 2008. The second reason is the 2020 recession. A lot of experts have been claiming that a recession is around the corner. The major reason is the slowing global growth that the statistics have shown. Several reports that were published in July from World Bank Group claimed that the global growth will go down to 2.6% in 2019. The reason behind slowing global growth goes back to several raised trade barriers, geopolitical tensions among countries and Brexit uncertainty. As a result, a lot of central banks from advanced economies start buying gold. This is done because countries want to diversify portfolio away from US dollar and thus, hedge against the harm that a financial crisis could likely bring in. China’s gold reserves rose to 62.26 million ounces from June’s 61.94 million ounces, which equated to about 10 tonnes bought in July. China’s central bank has been purchasing gold on a monthly basis since December, increasing the value of total gold reserves as of the end of July to $88.9 billion. In fact, reports have also claimed that new buyer counties have entered the commodity market since last two to three years in order to buy gold. These countries are Poland and Hungary. Reports from World Gold Council depicts that central banks worldwide have bought 224.4 tonnes of gold which is up from 238 tonnes in 2018.

Going back to the decreased growth indicators, in the second quarter, UK’s GDP was weaker than expected, contracting the economy further by 0.2% than the previous month. Moreover, Bank of England lowered UK’s growth to 1.3% citing slow economic growth due to Brexit and global world war tension. Similarly, US’s economy slowed but still grew at a 2.1% rate in the second quarter. China’s grew at 6.2%, which is down from 6.4% as compared to the period before; It is also China’s slowest growth pace since 1992.Back in April, Malyasia, Taiwan, South Korea, Japan also experienced slower manufacturing activity including Germany saw one of the biggest annual decline in manufacturing in last nine years. All these have predicted a global financial crisis around corner. In fact, the David Malpass, World Bank’s president quoted in one of his interviews “Rising trade barriers, a buildup of government debt are extending slowdowns in major economies are all contributing to slower global economic growth. These factors are rather worrisome and underdeveloped and developing economies would have to bear the cost”.

One more factor that has contributed to the gold price is the increase in import duty on gold by Indian government in July’s Budget. The import duty increased from 10% to 12.5%, leading to increased landing cost. Nepal imports majority of gold through India so, the import duty has impacted the retail price of gold in Nepal.

Finally, the major reason for the gold price hike has also been Fed interest rate cut. The US Federal Reserve cut its target base interest rate by 2 to 2.5%, 25 basis points, for the first time since 2008 crisis. Although Fed made it clear that the interest rate cut is not the beginning of a series of interest rate cuts, investors are predicting that Fed might further escalate interest rate cuts if the mid-September negotiations on trade war between China and US does not go well. The charm of yellow metal increases when steps such as interest rate cut is levied by Fed as returns from other sectors might go down but returns from gold will rise. As a result, a lot of investors switch to gold commodity market so, gold prices is pushed up.

Although a mid-September negotiation on trade talks between China and US has been agreed upon, US President Trump has announced that he is skeptical that any solutions might come through. He announced to impose further tariffs on Chinese imports if trade talks don’t go as expected. So, the price of gold for now depends upon the trade war negotiations and the global growth statistics.